corporate governance | sustainability | konoike transport-九州现金网

basic philosophy

we at the konoike group believe that meeting our social responsibility is an important part of our mission.

we strive to build corporate value as we build relationships of trust with society in the practice of our corporate philosophy and to pursue innovation at the foundations of our society that creates unique value, driven by respect for humanity and relationships of trust.

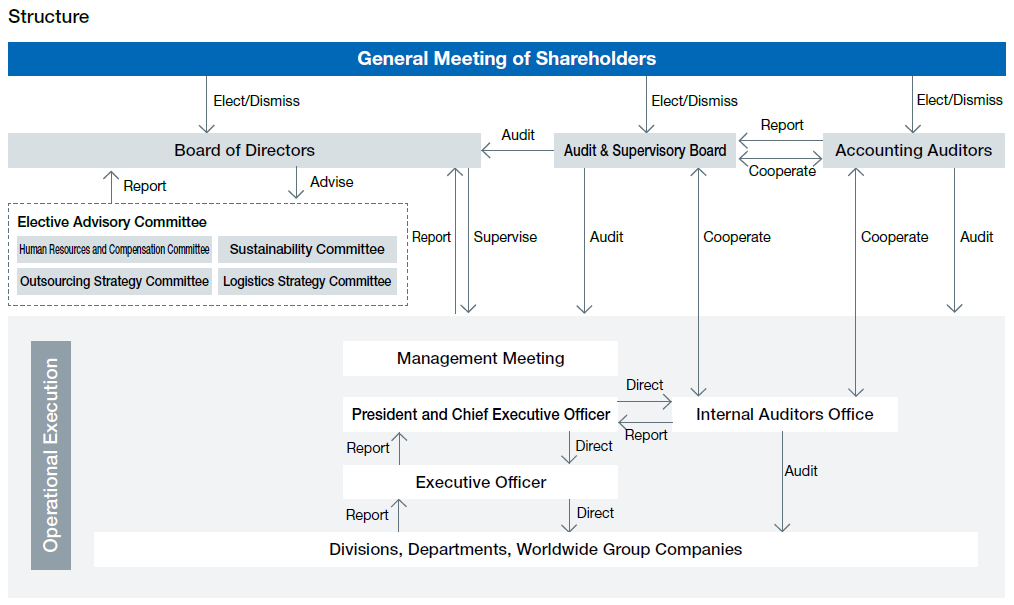

driven by this philosophy, we use our business activities to build positive relationships with our stakeholders as we engage in responsive, efficient, sound, fair, and transparent business practices. to this end, we continue to strengthen our supervisory functions and provide information disclosure, introducing new measures as necessary.

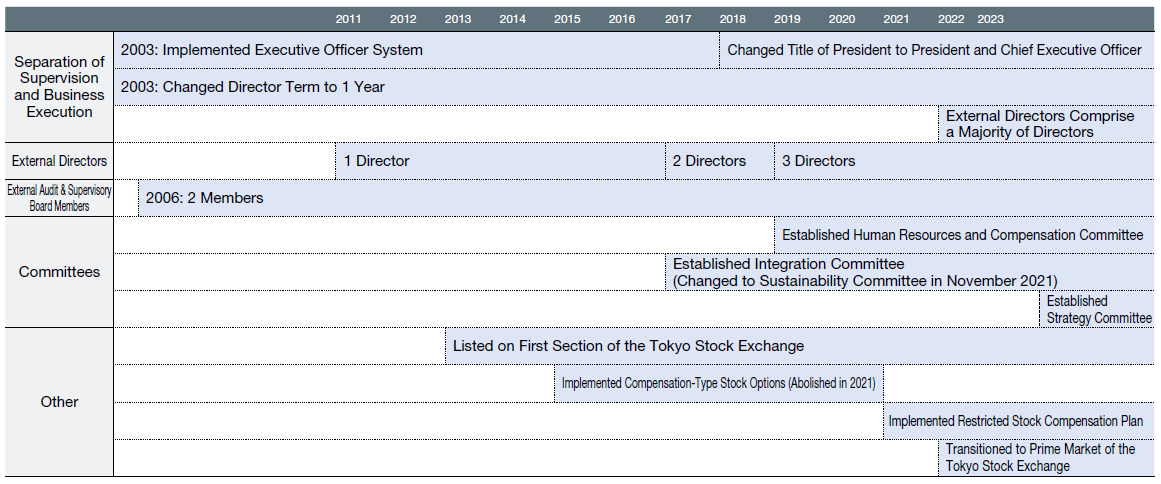

corporate governance improvement timeline

composition of the board of directors

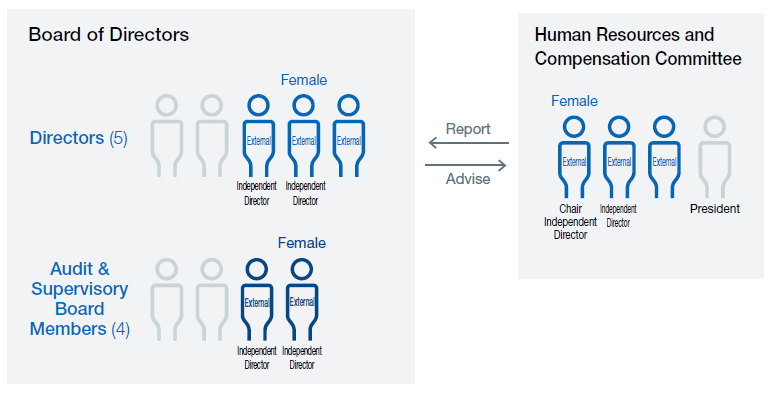

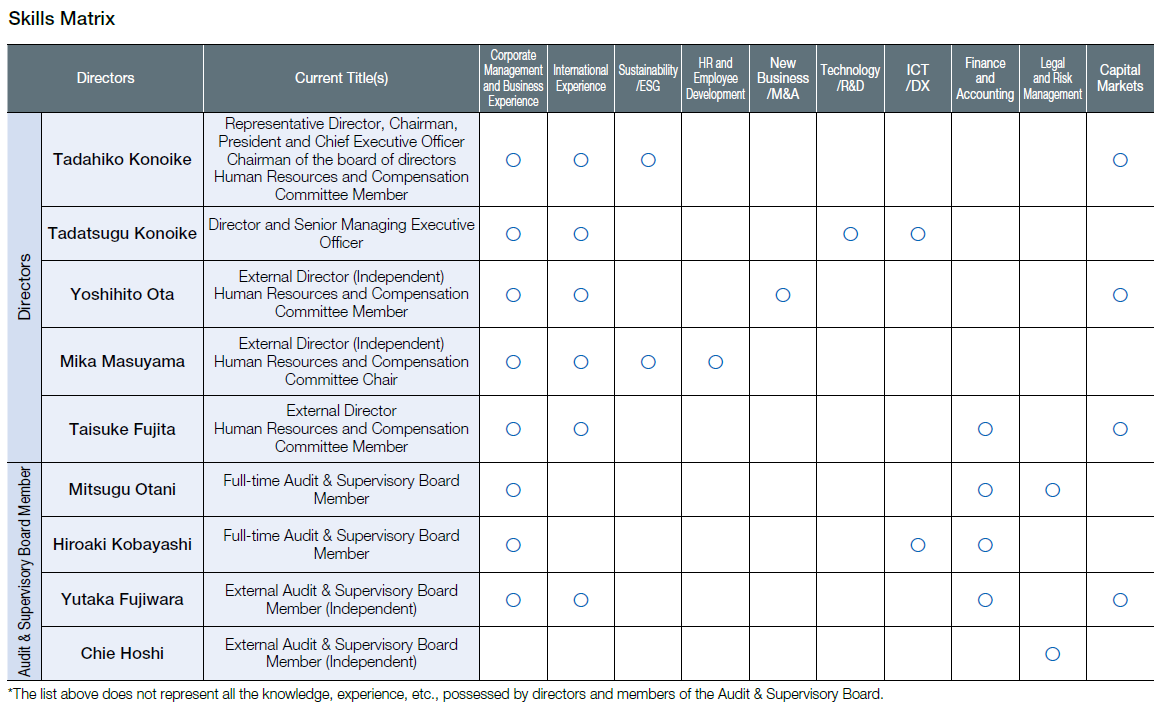

to distinguish clearly between management oversight and business execution, three of the five members of the board of directors are external directors, while two of the four members of the audit &supervisory board are external members. further, we have filed notice with the tokyo stock exchange for four of these five external officers to be designated as independent directors. in june 2019, we established the human resources and compensation committee, an elective advisory committee to the board of directors, and we will work toward further strengthening our corporate governance.

as of june 22 , 2023

human resources and compensation committee

activities in fy3/2023

the committee met a total of 11 times at the direction of the board of directors. the committee discussed appointments and compensation of directors and executive officers, reporting on the discussions to the board.

the human resources and compensation committee consists of two independent external directors, one external director, and one internal director, making a total of four members (as of march 31, 2023). although only half of the members are independent outside directors, we believe that the independence and objectivity of the committee is still ensured because the chairperson is an independent outside director.

officer compensation system

1.basic policy

we have established the following basic policy to ensure our officer compensation system supports our corporate philosophy (our mission), which reads, “we pursue innovation at the foundations of our society that creates unique value, driven by respect for humanity and relationships of trust.”

- the director compensation system must contribute to realizing the corporate philosophy (our mission)

- the director compensation system must aid in recruiting and retaining a talented management team intent on achieving our 2030 vision

- the director compensation system must encourage a constant spirit of ambition to go beyond expectations

- the director compensation system must be designed to link compensation closely to corporate earnings

- the director compensation system must continue to pay compensation linked to share prices over the medium to long term

- the director compensation system must be designed to guarantee fairness and transparency, ensuring that officers are accountable to employees, shareholders, and other stakeholders

2.determination of compensation

the board of directors decides the amount of compensation given to each director based on the findings of the human resources and compensation committee. the amount of compensation given to each full-time audit & supervisory board member is decided by discussion among members of the audit & supervisory board. specific amounts are based on compensation limits approved by the general meeting of shareholders and take into account company earnings, compensation levels at other companies, employee salaries, etc.

| position | total compensation (millions of yen) | total compensation amount by type (millions of yen) | number of eligible officers | ||

|---|---|---|---|---|---|

| basic compensation | performance-linked compensation (bonuses) | non-monetary compensation (restricted stock) | |||

| directors | 200 | 116 | 58 | 25 | 7 |

| (external directors, included) | (37) | (37) | (ー) | (ー) | (3) |

| audit & supervisory board members | 70 | 70 | ー | ー | 4 |

| (external audit & supervisory board members, included) | (22) | (22) | (ー) | (ー) | (2) |

| total | 270 | 186 | 58 | 25 | 11 |

| (external officers, included) | (59) | (59) | (ー) | (ー) | (5) |

- the above table is inclusive of the amounts paid to two directors (none of whom were external members) who retired at the conclusion of the 82nd annual general meeting of shareholders, held on june 23, 2022.

- the amount of compensation for directors does not include employee salaries of directors who concurrently serve as employees.

evaluating the effectiveness of the board of directors

since fy3/2016, our board of directors has conducted an annual evaluation of the composition and operation of the board, board deliberation content, and support systems. we have worked to strengthen the functions of the board to ensure a sustained increase in corporate value for the konoike group.

evaluation method

| evaluator | self-evaluation by board of directors and audit & supervisory board members |

|---|---|

| evaluation method | questionnaire format |

| response format | non-anonymous |

| evaluation items | evaluation and additional comments on following items

|

evaluation process

- questionnaire to all members of board of directors and audit & supervisory board members

- aggregation by the secretariat

- self-evaluation by board of directors based on questionnaire results

- exploration based on evaluation results

overview of fy3/2023 evaluation results

the composition of the board of directors has been evaluated as appropriate in terms of the overall number of directors and the balance between the number of inside and outside directors. management has been functioning effectively; however, it has been suggested that more time be allocated for deliberation and discussion, with an emphasis on priority issues set forth in the medium- to long-term vision and the medium-term management plan. it has also become clear that there is a need to further discuss the business portfolio and other issues in order to determine the future direction of the company.

going forward

in light of the results above, we are considering improvements to the following items.

- review business operations to improve discussions at meetings of the board of directors

- review of what is reported to improve the quality of monitoring

activities in fy3/2023

major agenda items

the board of directors met 17 times in fy3/2023. the following are items on the agendas at meetings.

- establishing, amending, and abolishing various rules

- organizational changes

- important business plans

- matters related to m&a

- matters related to the general meeting of shareholders (e.g., deciding what matters to discuss during general meeting of shareholders)

- matters related to stocks

- disclosures (public announcements of company information)

- purchasing, leasing, and other means of securing buildings, nonbuilding structures, and land (e.g., in relation to establishing new bases of operations)

- appointments of executive officers

- matters related to finance (e.g., matters related to long-term loans payable and short-term loans payable)

- matters related to affiliates

- other important matters related to management

main items on agenda for discussion

the board of directors met in may 2022 and discussed the results of a questionnaire regarding their own effectiveness as a board. at that meeting, items were set for discussion at future board meetings on important management issues, including business strategy, human resource development, and the results of our engagement with shareholders and investors.

- monitoring management indicators

to establish a supervision system of the management plan’s progress and to determine when reviewing is necessary, there were productive discussions on how to regularly monitor management indicators from an investor’s perspective and where investment should be targeted, such as which countries/regions and industries.

in addition, given the differences in the profit structure of each industry, opinions were exchanged on how to think about the balance sheet in each of them.

- non-financial targets (people, technology)

the discussion focused on our investment in people and technology because the importance of this was recognized when it comes to investing in non-financial capital in the sustainable enhancement of our corporate value.

human capital is particularly important for our integrated solutions business. on the subject of this form of capital, there were further productive discussions on the need to deepen the connection between management strategy, human resources policy, and human resource development, as well as how to allocate human resources in a more strategic and flexible manner.

defining our unique technological capital and its importance were also discussed, as well as the position this capital has with regard to our competitiveness and how we can strengthen it. the directors were all of the opinion that continuous improvements, operational efficiencies, and safety initiatives at each site are what essentially form the technological capital that differentiates us, thus becoming the lifeblood of our competitiveness and value creation.

- discussions on business strategy with the general managers of each business division

in october and december 2022, our directors and the general managers of the airport and medical divisions—priority businesses in our business portfolio—discussed the specific goals and policies of the 2030 vision. in addition, they also deliberated on the progress of our medium-term management plan (from fy3/2023 to fy3/2025) as well as solutions to various other issues. there was productive discussion on how to objectively reassess each division’s strengths and opportunities and how to tie these in with our next medium-term management plan.

- discussions on engagement with shareholders and investors

management issues from an ir perspective were discussed in terms of the pdca cycle as it relates to ir. this subject is regularly discussed and is considered an on-going issue. in particular, the discussions focused on strengthening and developing roic management, which is recognized as spearheading the logistics industry. in addition, with regard to strengthening non-financial capital, such as diversity and human capital, it was agreed that we share the important points that come out of our investor engagement. it was also agreed that deeper understanding will be achieved by making our future initiatives clear and explaining them thoroughly to investors.

- discussions on monitoring investment

the board of directors had constructive discussions on the progress of investment projects submitted to the management meetings or the board of directors in the past and the direction these important projects will go in the future. the following were among some of the many points raised and discussed: the need for more in-depth discussions on projects that deviate significantly from the initial business plan; the need to reassess not only the merits and drawbacks of individual projects but also their strategic context; the need to set capital costs and investment criteria according to the characteristics of each investment; and matters to consider when preparing a business plan. the board of directors recognized these discussions were an opportunity to identify areas for improvement in the investment pdca cycle from a broad perspective.

training future leaders

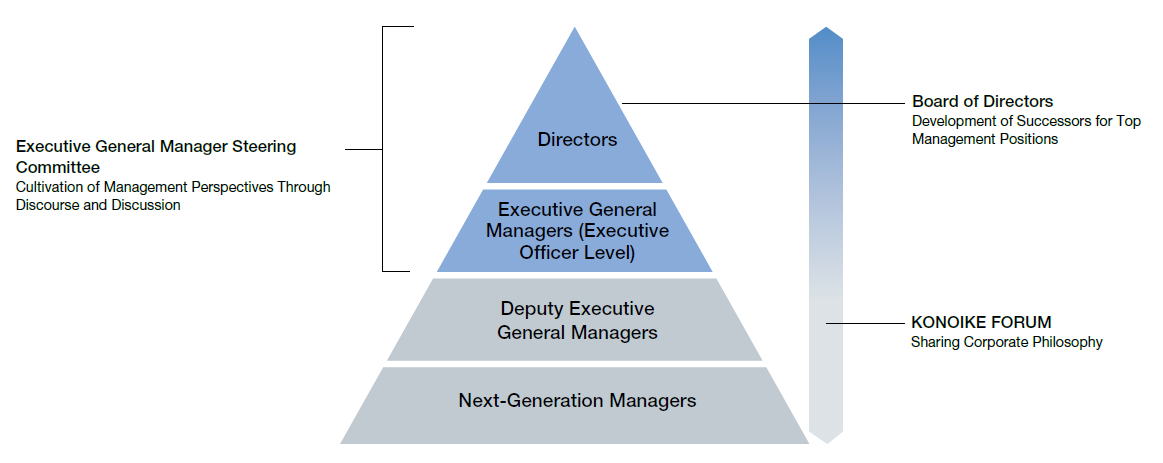

human resource development is a core component of sustainable growth for the konoike group. the president, directors (serving concurrently as managing executive officers), and executive general managers (executive officer level) meet once every month at the executive general manager steering committee to share information about operational execution. executive general managers, through discourse and discussion with directors, seek to cultivate their perspectives as managers. in addition, as one of a number of initiatives to further enhance the human resources foundation, a forum for deliberation is held as needed. here, members exchange opinions about strategies, philosophies, and other areas related to the konoike group, leading

to a desire to launch new businesses and expand existing domains. in addition, individuals regarded as our next generation of managers, such as those who will become department heads at headquarters and branch managers, get to build relationships of mutual trust at work. we also sponsor in-house seminars to bring together these potential managers and people who are already managers so that they share our corporate philosophy and behavioral guidelines. in this way, we pass on the experience and expertise necessary for management without interruption between generations.

strategic shareholdings

1. basic policy

konoike transport co., ltd. holds stock strategically to enhance our corporate value over the medium to long term. we do this by working to sustain and strengthen trade relationships with the customers who are vital to our business, as partnerships are key to konoike transport co., ltd. business activities across a range of areas.

each year, the board of directors regularly verifies the appropriateness of holdings of individual strategic stocks. the board considers whether the risks and benefits of holding these shares are commensurate with the accompanying cost of capital. if the board determines that holding a stock is not rational, the group sells said stock to reduce strategic holdings.

2. criteria for exercising voting rights

konoike transport co., ltd. does not make uniform decisions on policies when exercising voting rights for strategically held stocks. rather, we consider and decide each case separately from perspectives that include sustainable growth and improvement in medium- to long-term value of the company in question. we never approve resolutions that would be harmful to shareholder value.

risk management

basic policies for risk management

the konoike group established the risk management regulations and crisis management standards as the basic policies of the group to reduce risks that may have a significant impact on corporate management. through these policies, we also aim to establish a crisis management system that can respond quickly and appropriately in the event of an emergency.

risk management system

based on the aforementioned risk management regulations, the konoike group identified risks with the potential to harm corporate value and defines them as follows.

- the risk of poor strategic decision-making that could interfere with konoike group efforts to grow, resolve sustainability issues, and enhance our corporate value in the future

- the risk of insufficient legal compliance, inadequate initiatives on management issues, or other matters that could interfere with the sound development of existing business activities or operations, or which could damage current corporate value

our approach to managing these risks is based on prevention and containment. we work to maintain our current corporate value and enhance corporate value in the future by preventing incidents or issues and fulfilling our social responsibility.

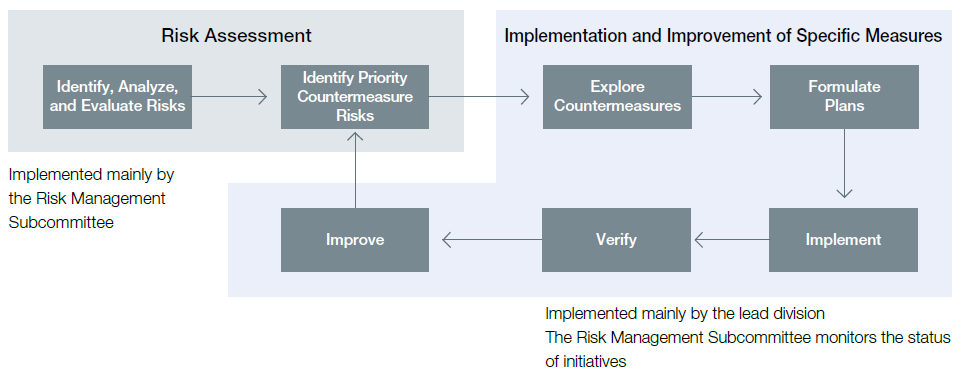

the risk management subcommittee, chaired by the officer in charge of risk management, meets quarterly to check on risk countermeasures and monitor the status of initiatives that focus on priority risks selected based on a risk map. the subcommittee also conducts other activities aimed at risk reduction.

the risk management subcommittee joins each branch and affiliated company to avoid risk occurrence on a group-wide basis.

crisis management system

we define a crisis as any situation that threatens the survival or business continuity of the konoike group, whether such a situation is caused by internal or external factors, arises suddenly, or is a result of poor management. we define crisis management as an emergency response, recovery activities, or business continuity activities in response to a crisis. we have built a system capable of responding appropriately and rapidly to events, one example of which is the aforementioned crisis management standards. we prepare various manuals for ready use in case of natural disaster.

the crisis management committee convenes in the event of risks such as large-scale natural disasters, including huge earthquakes and pandemics, that make it difficult to continue business operations. the committee is headed by the individual serving as representative director, chairman, president, and chief executive officer. if we determine the presence of a real emergency, we set up a command center to deal with the situation. in addition to the system establishment, we also conduct disaster-preparedness drills for setting up a task force, safety and confirmation drills, and other exercises. these drills enable us to sharpen our ability to respond to emergencies and minimize damage. the konoike group has also accumulated experience in emergency response to natural disasters such as earthquakes and typhoons through our history of providing emergency support for social infrastructure through logistics, medical care, and airport operations. we intend to leverage our knowledge to actively contribute to the support of disaster-stricken areas in the event of a disaster.

konoike group risk assessment

risk assessment is our first step in the risk management process. in risk management, the konoike group focuses on analysis and evaluation to determine the current status of risks.

these efforts are an important process in risk management, aiming to collect basic data for decision-making, such as the exploration and prioritization of countermeasures. risk assessments are conducted by the risk management subcommittee under the supervision of the sustainability committee. for priority countermeasure risks identified in the risk assessment, we appoint a division responsible for leading specific countermeasure implementation and improvements.

the risk management subcommittee is responsible for monitoring the status of initiatives in these divisions.

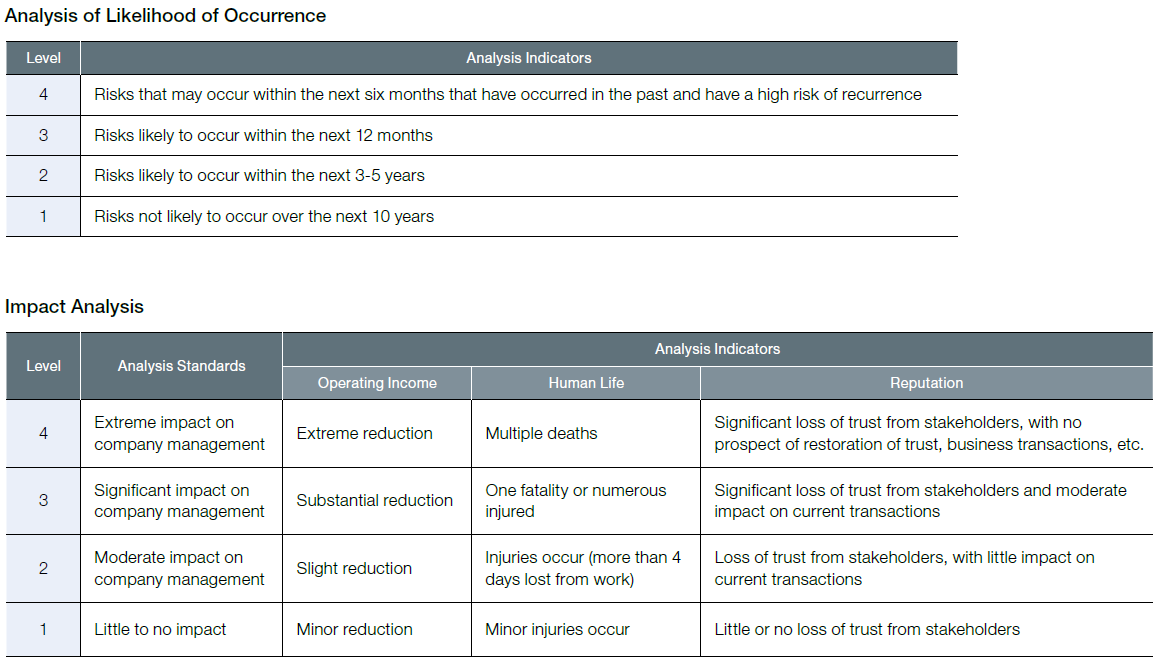

evaluation in risk assessment